UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.__)No.)

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | ||

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

Vital Farms, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than The Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table | |||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

April 26, 2021MESSAGE FROM THE EXECUTIVE CHAIRPERSON OF THE BOARD OF DIRECTORS

Dear Stockholders:Fellow Stockholders,

Our annual meeting of stockholders is an important marker every year for Vital Farms. It’s a moment to reflect on how we’re delivering on the commitments we’ve made to stakeholders and backing up our mission to bring ethical food to the table.

Vital Farms had a remarkable year in 2023. For over 16 years, we have methodically built this business with a long-term view by working with all of our stakeholders toward sustainable, positive outcomes. That approach is paying off through the scale we’ve achieved in our business, the deep relationships that we have across our stakeholder community and a strong foundation that we continue to invest in.

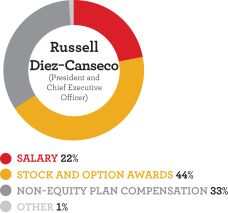

Vital Farms’ President and Chief Executive Officer, Russell Diez-Canseco, continues to champion this long-term approach to running the business while raising the standards. He has kept our company anchored in its purpose – to improve the lives of people, animals and the planet through food. Last year, Russell and Vital Farms’ leadership team laid out a vision to grow the company to $1 billion in net revenue by 2027. I have complete confidence in Russell and the team’s ability to lead Vital Farms to that important milestone and beyond.

As we look ahead to our 2024 Annual Meeting of Stockholders, I want to highlight two achievements that reinforce the Board’s confidence in our continued growth and commitment to purpose:

company, we’ve achieved – and in many cases beaten – every major financial target we’ve set. We believe that we’re well positioned to continue this track record in the coming years. Our 2023 performance shows us that we have the right foundation to continue driving profitable growth through a disciplined approach to capital resource allocation, operational excellence and adherence to our stakeholder model. |

As the founder, you’d think I would be pleased with the way our combined crew continues to build the company and the results we’ve achieved to date... and you’d be right. But I also view Vital Farms as a startup, even today. We have so much more to do, and we have the resources and determination to do it.

We arelook forward to continuing to work with you all in our ongoing purpose, to improve the lives of people, animals and the planet through food.

| Sincerely,

Matthew O’Hayer Founder and Executive Chairperson April 29, 2024 |  |

MESSAGE FROM THE PRESIDENT

AND CHIEF EXECUTIVE OFFICER

Dear Fellow Stockholders,

We’re pleased to invite youshare our annual proxy statement and extend an invitation to attend the 20212024 Annual Meeting of Stockholders of Vital Farms, Inc., a Delaware public benefit corporation

Our 2024 Annual Meeting of Stockholders (“Vital Farms”Annual Meeting”) towill be held virtually on Wednesday, June 9, 202112, 2024, at 9:00 a.m., Central time. As part of our precautions regarding the ongoing COVID-19 pandemic and to support the health and well-being ofTo provide an easily accessible experience for our stockholders, we have adoptedwill continue to utilize a virtual format for our 20212024 Annual Meeting, which will be heldconducted solely online. There will not be a physical location for the Annual Meeting, and you will not be able to attend the Annual Meeting in person.

You will be able to attend the Annual Meeting, ask yoursubmit questions in advance of the meeting and vote your shares during the meeting by visiting www.proxydocs.com/VITL. To participate in the Annual Meeting, you will need to register to attend the meeting by 5:00 p.m., Central time, on June 8, 202111, 2024, using the control number located on the Notice of Internet Availability of Proxy Materials for the 20212024 Annual Meeting of Stockholders, your proxy card or voting instruction form. Additional details regarding access to the Annual Meeting and the business to be conducted at the Annual Meeting are described in the accompanying Notice of 20212024 Annual Meeting of Stockholders and proxy statement.

We have elected to provide access to our proxy materials over the Internetinternet under the U.S. Securities and Exchange Commission’s “notice and access” rules. As a result, we are mailing to our stockholders a Notice of Internet Availability of Proxy Materials instead of paper copies of the proxy statement and our 20202023 Annual Report.Report on Form 10-K. The notice contains instructions on how to access those documents over the Internet.internet. The Notice of Internet Availability of Proxy Materials also contains instructions on how stockholders can receive a paper copy of our proxy materials, including the proxy statement, our 20202023 Annual Report on Form 10-K and a form of proxy card or voting instruction form. We believe that providing our proxy materials over the Internetinternet increases the ability of our stockholders to connect with the information they need, while reducing the environmental impact and cost of our Annual Meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible. You may vote over the Internet,internet, by telephone or,

if you receive a paper proxy card by mail, by completing and returning the proxy card or voting instruction form mailed to you. Please carefully review the instructions on each of your voting options described in this proxy statement, as well as in the Notice of Internet Availability of Proxy Materials you received in the mail.

As we look ahead to our Annual Meeting, I want to once again thank all of our stakeholders for their contributions to our shared, continued success. Our crew members, farmers and suppliers, stockholders, customers and consumers, the animals that produce our eggs and butter, the communities where we operate and the environment all played important roles in delivering a landmark year for Vital Farms. I also want to thank our Board of Directors for their continued guidance, and our Founder and Executive Chairperson, Matt O’Hayer, for his friendship and counsel.

Vital Farms makes decisions in the long-term interests of all of our stakeholders. Our commitment to that approach, and the consistency with which we take the long view, have laid the foundation for this important growth chapter. We’re now positioned to make investments that accelerate our growth and keep us on track to deliver on our most important stakeholder commitments, including growing to $1 billion in net revenue by 2027, serving more farmers and customers through our next egg washing and packing facility, executing our digital transformation and developing our talented crew members.

We believe that momentum is building at Vital Farms. Every one of our stakeholders contributed to our continued work to improve the lives of people, animals and the planet through food. And, by design, all of our stakeholders benefit from the remarkable results we deliver together.

2023 Highlights:

Financial Results: We’re on track to meet the ambitious multi-year goals that we laid out at our 2023 Analyst Day, including our goal to grow to $1 billion of net revenue, 35% gross margin and 12-14% Adjusted EBITDA Margin by 2027. Net revenue increased 30.3% last year to $471.9 million, gross profit was $162.3 million, or 34.4% of net revenue, net income was $25.6 million and Adjusted EBITDA was

$48.3 million, or 10.2% of net revenue.1 This marks the first full fiscal year since our initial public offering with double-digit Adjusted EBITDA Margin, which we believe demonstrates the benefits of our growing scale. |

with our incredibly talented and dedicated crew, is a big reason we’re able to continually meet growing customer demand and progress toward our growth targets. Our supply chain model and our ability to execute have enabled us to successfully navigate potential disruptions like avian influenza without significantly impacting our commitments to customers and consumers. |

On behalf of the Board of Directors and the crewmembers of Vital Farms wecrew members, thank you for your continued support andsupport. I look forward to seeing youyour attendance at theour Annual Meeting.

| Sincerely,

Russell Diez-Canseco President and Chief Executive Officer April 29, 2024 |  |

Russell Diez-Canseco

Chief Executive Officer

| 1 | Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP measures and are reconciled to their closest comparable GAAP measures in Annex A. Non-GAAP financial measures are not an alternative for Vital Farms’ reported results prepared in accordance with GAAP. |

| NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS |

VITAL FARMS, INC. 3601 South Congress Ave. Suite C100 Austin, Texas 78704 |

VITAL FARMS, INC.

3601 South Congress Ave.

Suite C100

Austin, Texas 78704

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS

Date:

Wednesday, June 9, 202112, 2024

Time:

9:00 a.m., Central time

Place:

The Annual Meeting can be accessed by visiting www.proxydocs.com/VITL. You must register to attend the meeting online at www.proxydocs.com/VITL by no later than 5:00 p.m., Central time, on June 8, 202111, 2024, using your control number included in the Notice of Internet Availability of Proxy Materials mailedyou received in the mail. Stockholders attending the virtual meeting will be afforded the same rights and opportunities to youparticipate as they would at www.proxydocs.com/VITL.an in-person meeting, including the ability to submit questions in advance and to vote.

Record Date:

The record date for the Annual Meeting is April 12, 2021.19, 2024. Only stockholders of record at the close of business on that date may vote at the Annual Meeting or any adjournment thereof. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying proxy statement.

Items of Business:

The Annual Meeting will be held for the following purposes, which are more fully described in the proxy statement accompanying this Notice:

| (1) | To elect the |

| (2) | To ratify the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December |

| (3) | To conduct any other business properly brought before the meeting or any adjournment or postponement thereof. |

Your vote is important. Whether or not you expect to attend the virtual Annual Meeting, please vote by telephone or through the Internet,internet, or, if you receive a paper proxy card by mail, by completing and returning the proxy card mailed to you, as promptly as possible in order to ensure your representation at the Annual Meeting. Voting instructions are provided in the Notice of Internet Availability of Proxy Materials, or, if you receive a paper proxy card by mail, the instructions are printed on your proxy card and included in the accompanying Proxy Statement.proxy statement. Even if you have voted by proxy, if you register to attend the Annual Meeting, you may still vote online during the Annual Meeting. Please note, however, that if your shares are held of record by a brokerage firm, bank or other agent and you wish to vote online at the Annual Meeting, you must obtain a proxy issued in your name from that agent in order to vote your shares that are held in such agent’s name and account.

Sincerely,

Jason DaleJoanne Bal

Corporate Secretary

Austin, Texas

April 26, 202129, 2024

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement contains “forward-looking” statements, as that term is defined under federal securities laws in the United States, including but not limited to statements regarding our growth potential and plans, our long-term financial targets, our impact goals and our expectations regarding our future operating and business environment. All statements other than statements of historical facts contained in this proxy statement, including statements regarding our future results of operations or financial condition, business strategies, goals, initiatives, commitments and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “aim,” “anticipate,” “believe,” “continue,” “could,” “expect,” “forecast,” “goal,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will” or “would” or the negative of these words or other similar terms or expressions. These forward-looking statements are subject to substantial risks, uncertainties, assumptions, and changes in circumstances that may cause actual results, performance, or achievements to differ materially from those expressed or implied in any forward-looking statement.

The risks and uncertainties referred to above include but are not limited to those risks described in our filings with the Securities and Exchange Commission (SEC), including in the sections entitled “Risk Factors” in our latest annual report on Form 10-K and our quarterly reports on Form 10-Q and in our other filings and reports that we may file from time to time with the SEC, which can be found at https://investors.vitalfarms.com/. References to our website throughout this proxy statement are provided for convenience only, and the content on our website does not constitute a part of this proxy statement.

Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual performance and results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, we cannot guarantee future results, levels of activity, performance, achievements, or events and circumstances reflected in the forward-looking statements will occur. Forward-looking statements represent management’s assumptions, expectations and beliefs only as of the date of this proxy statement. We disclaim any obligation to update forward-looking statements except as required by law.

PAGE | ||||||

| 1 | QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING | |||||

| 8 | ||||||

| 9 | ||||||

| 10 | ||||||

| 10 | ||||||

| 10 | ||||||

| 14 | ||||||

| 14 | ||||||

| 15 | INFORMATION REGARDING THE BOARD AND CORPORATE GOVERNANCE | |||||

| 16 | ||||||

| 16 | ||||||

| 17 | ||||||

| 18 | ||||||

| 18 | ||||||

| 24 | ||||||

| 24 | ||||||

| 24 | ||||||

| 24 | ||||||

| 25 | ||||||

| 25 | ||||||

| 25 | Hedging, Pledging Shares and other Transactions Involving Company Stock | |||||

| 27 | OUR COMMITMENT TO IMPACT | |||||

| 34 | PROPOSAL 2—RATIFICATION OF THE SELECTION OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |||||

| 35 | ||||||

| 35 | ||||||

| 35 | ||||||

| 36 | ||||||

| 37 | ||||||

| 40 | ||||||

| 41 | ||||||

| 46 | ||||||

| 48 | ||||||

| 48 | ||||||

| 49 | EQUITY COMPENSATION PLAN INFORMATION | |||||

| 51 | ||||||

| 52 | ||||||

| 52 | Policies and Procedures Regarding Transactions with Related Persons | |||||

| 53 | ||||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | ||||||

| 56 | ||||||

| A-1 | ||||||

| 2024 Proxy Statement | |||||||

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

i

VITAL FARMS, INC.

3601 South Congress Ave.

Suite C100

Austin, Texas 78704

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receivea Notice of Internet Availability of Proxy Materials on the internet instead of a full set of Proxy Materials?

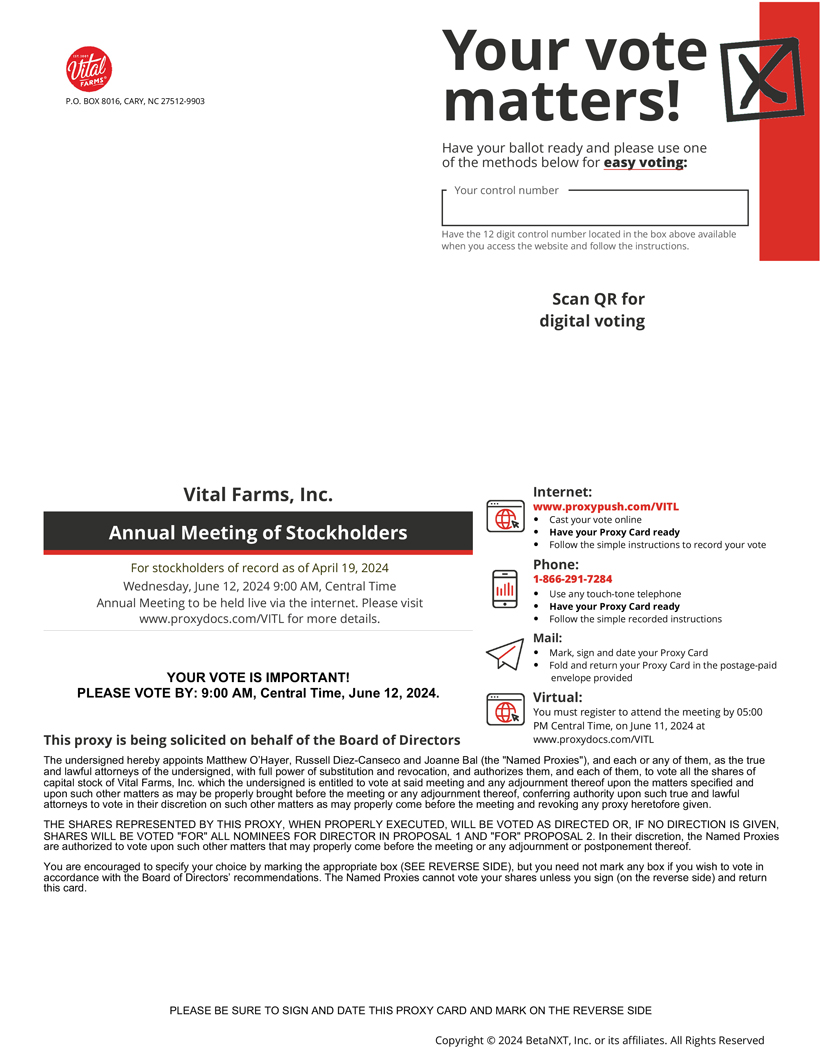

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”“SEC”), Vital Farms, Inc. (“we have” or the “Company”) has elected to provide access to our Proxy Materials (as defined below) over the Internet.internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) because the Board of Directors of Vital Farms, Inc.the Company (the “Board”“Board”) is soliciting your proxy to vote at the 20212024 Annual Meeting of Stockholders (the “Annual Meeting”“Annual Meeting”) of Vital Farms, Inc.,the Company, including at any adjournments or postponements thereof, to be held on Wednesday, June 9, 202112, 2024 at 9:00 a.m., Central time. The Annual Meeting can be accessed by visiting www.proxydocs.com/VITL. You will need to register to attend or participate in the Annual Meeting by 5:00 p.m., Central time, on June 8, 202111, 2024, using the control number provided on the Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) or your proxy card, if applicable.

The Notice of 20212024 Annual Meeting of Stockholders (“Notice of Annual Meeting”Meeting”), this proxy statement, the proxy card or voting instruction form and our Annual Report on Form 10-K for the fiscal year ended December 27, 202031, 2023 (the “Annual Report”“Annual Report” and collectively, the “Proxy Materials”“Proxy Materials”) are available to stockholders on the Internet.internet.

The Notice of Internet Availability will provide instructions as to how a stockholder of record may access and review the Proxy Materials on the website referred to in the Notice of Internet Availability or, alternatively, how to request that a copy of the Proxy Materials, including a proxy card, be sent by mail or email to the stockholder of record. The Notice of Internet Availability will also provide voting instructions. Please note that, while our Proxy Materials are available at the website referenced in the Notice of Internet Availability, and our Notice of Annual Meeting, proxy statement and Annual Report are available on our website, no other information contained on either website is incorporated by reference in or considered to be a part of this document.

We intend to mail the Notice of Internet Availability on or about April 26, 202129, 2024 to all stockholders of record entitled to vote at the Annual Meeting. The Proxy Materials will be made available to stockholders on the Internetinternet on the same date.

What does it mean if I receive more than one Notice of Internet Availability?

If you receive more than one Notice of Internet Availability, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each notice to ensure that all of your shares are voted.

Will I receive any other Proxy Materials by mail?

You will not receive any additional Proxy Materials via mail unless you request a printed copy of the Proxy Materials in accordance with the instructions set forth in the Notice of Internet Availability. We may elect, in our discretion, to send you a proxy card and a second Notice of Internet Availability, which we may send on or after May 6, 2021.9, 2024.

When is the record date for the Annual Meeting?

The Board has fixed the record date for the Annual Meeting as of the close of business on April 12, 2021.19, 2024 (the “Record Date”).

Why is Vital Farms conducting a virtual Annual Meeting?

Due to the ongoing public health crisis relating to the COVID-19 pandemic, we believe that adopting the virtual meeting format will help protect the health and well-being of our directors, members of management and

stockholders who wish to attend the Annual Meeting. Stockholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting, including the ability to submit questions in advance and to vote. We believe that hosting a virtual meeting is in the best interest of our stockholders and enables increased stockholder attendance in light of the current circumstances.

How do I attend the Annual Meeting?

We will be hosting the Annual Meeting via live webcast only. You are entitled to attend the Annual Meeting if you were a stockholder as of the close of business on April 12, 2021, the record date,Record Date or hold a valid proxy for the meeting. To participate in the Annual Meeting, you will need to visit www.proxydocs.com/VITL and register by 5:00 p.m., Central time, on June 8, 202111, 2024, using the control number included on your Notice of Internet Availability, on your proxy card or on the instructions that accompanied your proxy materials, as applicable. If your shares are held by a broker, use the control number provided by your broker found on your notice or voting instruction form.

2 | 2024 Proxy Statement |

|

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

We recommend that you log in a few minutes before the Annual Meeting to ensure that you are logged in when the meeting starts. Information on how to vote online during the Annual Meeting is discussed below.

What if I cannot find my control number?

Please note that if you do not have your control number and you are a stockholder of record, please contact us at investors@vitalfarms.com and we will be able to provide your control number to you. If you are a beneficial owner (that is, you hold your shares in an account at a bank, broker or other holder of record), you will need to contact that bank, broker or other holder of record to obtain your control number prior to the Annual Meeting.

What do I do if I have technical difficulties in connection with the Annual Meeting?

Please note that in order to attend the Annual Meeting, you must register at www.proxydocs.com/VITL by 5:00 p.m., Central time, on June 8, 2021. You11, 2024. Upon registration, you will receive an email with additional information regarding how to access the Annual Meeting. The Annual Meeting will begin promptly at 9:00 a.m., Central time. We encourage you to access the Annual Meeting approximately 15 minutes in advance to allow ample time for you to access the meeting and test your computer audio system. We recommend that you carefully review the above procedures needed to gain admission in advance. Technicians will be ready to assist you with any technical difficulties you may have accessing the meeting. If you encounter any difficulties accessing the meeting during check-in or during the meeting, please call the technical support number that will be provided in your emailed instructions after your successful registration at www.proxydocs.com/VITL.

How do I ask a question at the Annual Meeting?

As part of the Annual Meeting, we will hold a question and answerquestion-and-answer session during which we intend to answer questions submitted prior to the meeting in accordance with the rules of conduct posted on the meeting website, as time permits. Only stockholders of record as of April 12, 2021the Record Date who have registered in advance to attend the Annual Meeting may submit questions or comments that may be addressed during the Annual Meeting. If you would like to submit a question, you may do so when you register to attend the Annual Meeting at www.proxydocs.com/VITL using the control number provided in the Notice of Internet Availability and typing your question in the appropriate box in the registration form. We do not intend to post questions received during the Annual Meeting on our website.

In accordance with the rules of conduct, we ask that you limit your question to one brief question that is relevant to the Annual Meeting or our business and that such questions are respectful of your fellow stockholders and meeting participants. Questions and answers may be grouped by topic, and substantially similar questions may be grouped and answered once. In addition, questions may be ruled out of order if they are, among other things, irrelevant to our business, related to pending or threatened litigation, disorderly, repetitious of statements already made, or in furtherance of the stockholder’s own personal, political or business interests.

Will a list of record stockholders as of the record date be available?

A list of stockholders entitled to vote at the meeting will be available for examination during normal business hours by any stockholder for any purpose germane to the meeting for the 10 days beforeending the meetingday prior to the Annual Meeting at our offices. Please email investors@vitalfarms.com to arrange for in-person examination. The stockholder list will also be available electronically during the meeting.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on April 12, 2021the Record Date will be entitled to vote online during the Annual Meeting. On this record date,the Record Date, there were a total of 39,921,29942,135,786 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on April 12, 2021,the Record Date, your shares were registered directly in your name with our transfer agent, American Stock Transfer &Equiniti Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote online during the meeting, vote by proxy over the telephone or through the internet, or vote by proxy using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted.

| 2024 Proxy Statement | 3 |

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Similar Organization

If on April 12, 2021,the Record Date, your shares were held not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice of Internet Availability is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares online during the meeting unless you request and obtain a valid proxy from your broker or other agent, as required. Check with your brokerage firm, bank, dealer or other similar organization, and further follow the instructions you receive during the registration process prior to the Annual Meeting.

What am I voting on?

There are two matters scheduled for a vote:

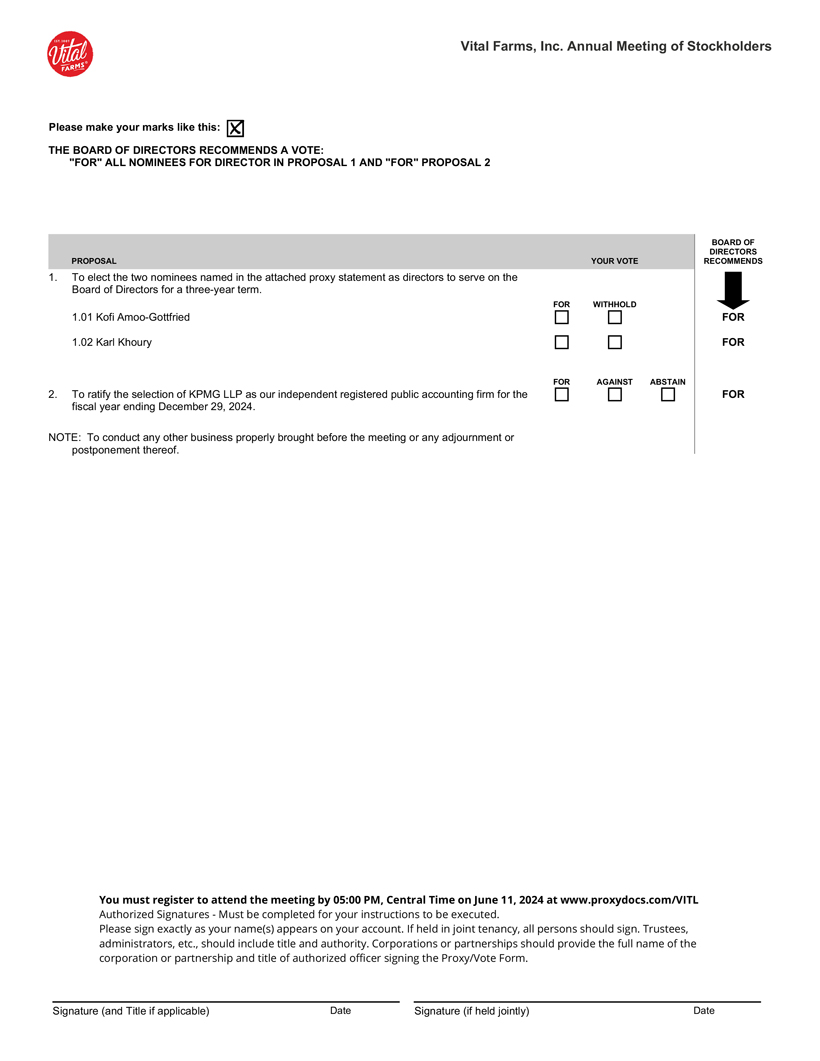

Proposal 1: Election of threetwo Class I directors to hold office until the 20242027 Annual Meeting of Stockholders; and

Proposal 2: Ratification of the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 26, 2021.29, 2024.

What if another matter is properly brought before the meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, the proxies will vote as recommended by the Board or, if no recommendation is given, will vote on those matters in accordance with their best judgment.

How do I vote?

If you are a stockholder of record and your shares are registered directly in your name, you may vote:

|

By Internet. To vote through the internet, go to www.proxypush.com/VITL to complete an electronic proxy card. You will be asked to provide the company number and control number from the Notice of Internet Availability. Your internet vote must be received prior to the start of the Annual Meeting to be counted.

By Telephone. Call 1-866-291-7284 toll-free from the U.S., U.S. territories and Canada, and follow the instructions on the Notice of Internet Availability. You will be asked to provide your control number from the Notice of Internet Availability. Your telephone vote must be received prior to the start of the Annual Meeting to be counted. |

|

|

By Proxy Card. Complete and mail the proxy card that may be requested and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

Online During the Annual Meeting. Access the Annual Meeting by visiting www.proxydocs.com/VITL and providing your control number from your Notice of Internet Availability. You must register to attend the Annual Meeting by 5:00 p.m., Central time on June 11, 2024 and follow the instructions you receive after your successful registration to access the Annual Meeting and to vote your shares during the meeting.

If your shares of common stock are held in street name (i.e., held for your account by a broker, bank or other nominee), you should have received a notice containing voting instructions from that organization rather than from us. You should follow the instructions in the notice to ensure your vote is counted. To vote online during the Annual Meeting, you may be required to obtain a valid proxy card from your broker or other nominee. Follow the instructions from your broker, bank or other nominee or contact your broker, bank or other nominee to request a proxy card, and access the Annual Meeting by following the instructions you receive after your successful registration at www.proxydocs.com/VITL using the control number provided by your bank, broker or other nominee.

Internet proxy voting will be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

4 | 2024 Proxy Statement |

|

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you ownowned as of April 12, 2021.the Record Date.

What are the Board’s recommendations on how to vote my shares?

The Board recommends a vote:

Proposal 1: FOR the election of the threetwo Class I director nominees; and

Proposal 2: FOR the ratification of the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 26, 2021.29, 2024.

Who pays the cost for soliciting proxies?

We will pay the entire cost of soliciting proxies. In addition to these Proxy Materials, our directors and employees may also solicit proxies in person, by telephone or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We will also reimburse brokers, banks, custodians, other nominees and fiduciaries for forwarding these materials to their principals to obtain the authorization for the execution of proxies.

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the Internetinternet or online during the Annual Meeting, your shares will not be voted. If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of each of the threetwo nominees for director and “For” the ratification of the selection of KPMG LLP as our independent registered public accounting firm. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

If I am a beneficial owner of shares held in street name and I do not provide my broker or bank with voting instructions, what happens?

If your shares are held in street name, your bank, broker or other nominee may under certain circumstances vote your shares if you do not timely instruct your broker, bank or other nominee how to vote your shares. Banks, brokers and other nominees can vote your unvoted shares on routine matters but cannot vote such shares on non-routine matters. If you do not timely provide voting instructions to your bank, broker or other nominee to vote your shares, your bank, broker or other nominee may, on routine matters, either vote your shares or leave your shares unvoted. The election of directors (Proposal 1) is a non-routine matter. The ratification of the selection of our independent registered public accounting firm (Proposal 2) is a routine matter. We encourage you to provide voting instructions to your bank, broker or other nominee. This ensures that your shares will be voted at the Annual Meeting according to your instructions. You should receive directions from your bank, broker or other nominee about how to submit your proxy to them at the time you receive this proxy statement.

If you are a beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agentnominee by the deadline provided in the materials you receive from your broker, bank or other nominee.

What does it mean if I receive more than one Notice of Internet Availability?

| 2024 Proxy Statement | 5 |

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

If you receive more than one Notice of Internet Availability, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each notice to ensure that all of your shares are voted.

Can I revoke my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. If you are the stockholder of record for your shares, you may revoke your proxy at any time before the final vote at the Annual Meeting in one of the following ways:

by submitting another properly completed proxy with a later date;

by transmitting a subsequent vote over the Internetinternet or by telephone prior to the start of the Annual Meeting;

by registering to attend and attending the Annual Meeting and voting online; or

by sending a timely written notice to our Corporate Secretary in writing at 3601 South Congress Ave., Suite C100, Austin, Texas 78704 that you are revoking your proxy.

Your last vote, whether prior to or at the Annual Meeting, is the vote that we will count.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Similar OrganizationNominee

If your shares are held in street name, you must contact your broker, bank or nominee for instructions as to how to change your vote. Your personal attendance at the Annual Meeting does not revoke your proxy. Your last vote, whether prior to or at the Annual Meeting, is the vote that we will count.

How is a quorum reached?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote at the meeting are present at the Annual Meeting or represented by proxy. On the record date,Record Date, there were 39,921,29942,135,786 shares outstanding and entitled to vote. Thus, the holders of 19,960,65021,067,894 shares must be present or represented by proxy at the Annual Meeting to have a quorum. The inspector(s) of election appointed for the Annual Meeting will determine whether or not a quorum is present.

Abstentions and broker non-votes, if any, will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the meeting or represented by proxy may adjourn the meeting to another date.

What are “broker non-votes”?

As discussed above,A “broker non-vote” occurs when your broker submits a beneficial owner of shares held in “street name”proxy for the meeting with respect to “routine” matters but does not give instructions to the broker or nominee holding the shares as to how to vote on “non-routine”matters deemed to be “non-routine,” the broker or nominee cannot vote the shares.because you did not provide voting instructions on these matters. These unvoted shares with respect to “non-routine” matters are counted as “broker non-votes.” Proposal 1 is considered to be “non-routine,” and we therefore expect broker non-votes to exist in connection with this proposal.

6 | 2024 Proxy Statement |

|

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

What vote is required to approve each item and how are votes counted?

Proposal 1: ElectionThe following table summarizes the minimum vote needed to approve each proposal and the effect of Directors. Directors will be elected by a plurality of votes cast at the Annual Meeting by holders of shares present or represented by proxy and entitled to vote. The three nominees receiving the most “For” votes will be elected as directors. You may not vote your shares cumulatively for the election of directors.Abstentionsabstentions and broker non-votesnon-votes. will not affect the outcome of the election of directors.

Proposal 2: Ratification of the Selection of the Independent Registered Public Accounting Firm. To be approved, the ratification of the selection of KPMG LLP as our independent registered public accounting firm for fiscal year ending December 26, 2021 must receive “For” votes from the holders of a majority of shares present or represented by proxy and entitled to vote. Abstentions will have the same effect as an “Against” vote.

PROPOSAL | PROPOSAL DESCRIPTION | VOTE REQUIRED FOR APPROVAL | EFFECT OF ABSTENTIONS | EFFECT OF BROKER NON-VOTES | MATTER | |||||

| 1. | Election of directors | Nominees receiving the most “For” votes; withheld votes will have no effect. | Not applicable | No effect | Non-routine | |||||

| 2. | Ratification of the selection of KPMG LLP as our independent registered public accounting firm | “For” votes from the holders of a majority of the voting power of the shares present in person, by remote communication or represented by authorized proxy and entitled to vote on the matter. | Against | Not applicable(1) | Routine | |||||

| (1) | This proposal is considered to be a “routine” matter. Accordingly, if you hold your shares in street name and do not provide voting instructions to your broker, bank or other nominee that holds your shares, your broker, bank or other nominee has discretionary authority to vote your shares on this proposal. |

How can I find out the results of the voting at the Annual Meeting?

We will announce preliminary voting results at our Annual Meeting. We will publish final voting results in a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting. If final voting results are not available at that time, we will disclose the preliminary results in the Current Report on Form 8-K and, within four business days after the final voting results are known to us, file an amended Current Report on Form 8-K to disclose the final voting results.

When are stockholder proposals and director nominations due for the 20222025 Annual Meeting of Stockholders?

If you wish to submit proposals for inclusion in our proxy statement for the 20222025 annual meeting of stockholders (the “2022“2025 Annual Meeting”Meeting”), we must receive them on or before December 27, 2021.31, 2024. Nothing in this paragraph shall require us to include in our proxy statement or proxy card for the 20222025 Annual Meeting any stockholder proposal that does not meet the requirements of the SEC in effect at the time. Any such proposal will be subject to Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”“Exchange Act”).

If you wish to nominate a director or submit a proposal for presentation at the 20222025 Annual Meeting, without including such proposal in next year’s proxy statement, you must be a stockholder of record and provide timely notice in writing to our Secretary at c/o Vital Farms, Inc., 3601 South Congress Ave., Suite C100, Austin, Texas 78704.78704, Attn: Corporate Secretary. To be timely, we must receive the notice not less than 90 days nor more than 120 days prior to the first anniversary of the Annual Meeting, that is, between February 9, 202212, 2025 and March 11, 2022;14, 2025; provided, however, that in the event that the date of the 20222025 Annual Meeting is more than 30 days before or more than 30 days after such anniversary date, we must receive your notice (a) no earlier than the close of business on the 120th day prior to the 20222025 Annual Meeting and (b) no later than the close of business on the later of the 90th day prior to the 20222025 Annual Meeting or the close of business on the 10th10th day following the day on which we first make a public announcement of the date of the 20222025 Annual Meeting. Your written notice must contain specific information required in Article III, Section 5 of our amended and restated bylaws (the “Bylaws”“Bylaws”). For additional information about our director nomination requirements, please see our Bylaws.

Who should I call if I have any additional questions?

If you are the stockholder of record for your shares, please call Matt Siler,Anthony Bucalo, our Vice President of Investor Relations, at (877) 455-3063 or email investors@vitalfarms.com. If your shares are held in street name, please contact the telephone number provided on your voting instruction form or contact your broker or nominee holder directly.

| 2024 Proxy Statement | 7 |

PROPOSAL 1: ELECTION OF DIRECTORS

Our amended and restated certificate of incorporation provides for a classified Board consisting of three classes of directors. Class I consists of three directors, Class II consists of three directors and Class III consists of three directors. Each class serves for a three-year term. Vacancies on our Board may be filled by the affirmative vote of a majority of directors then in office. A director elected by our Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified.

Our Board is currently composed of nineeight directors. There are threetwo directors whose term of office expires in 2021.2024. Upon the recommendation of the Nominating and Corporate Governance Committee, our Board has nominated the threetwo individuals listed in the table below for election as directors at the Annual Meeting. If the nominees listed below are elected, they will each hold office until the annual meeting of stockholders in 20242027 and until each of their successors has been duly elected and qualified or, if sooner, until the director’s resignation or removal. All nominees are currently serving on our Board and have consented to being named in this proxy statement and to serve if elected. It is our policy to encourage directors and nominees for director to attend the Annual Meeting.

The brief biographies below include information, as of the date of this proxy statement, regarding the specificnominees’ principal occupation, business experience and education, along with the particular experience, qualifications, attributes or skills that led the Nominating and Corporate Governance Committee to believe that each director or nominee should serve on the Board. There are no family relationships among any of our executive officers or directors. There are no arrangements or understandings between us and any director, or nominee for directorship, pursuant to which such person was selected as a director or nominee.

Nominees | Age(1) | Term Expires | Position(s) Held | Director Since | ||||||||||||||||||||

NOMINEES | AGE(1) | TERM EXPIRES | POSITION(S) HELD | DIRECTOR SINCE | ||||||||||||||||||||

Kofi Amoo-Gottfried | 41 | 2021 | Director | 2020 | 44 | 2024 | Director | 2021 | ||||||||||||||||

Brent Drever | 49 | 2021 | Director | 2019 | ||||||||||||||||||||

Karl Khoury | 51 | 2021 | Director | 2015 | 54 | 2024 | Director | 2015 | ||||||||||||||||

| (1) | As of April |

Kofi Owusu Amoo-Gottfried has served a member of our Board of Directors since January 2021. Mr. Amoo-Gottfried has served as Vice President of Marketing of Doordash Inc. since May 2019. Prior to joining Doordash, Mr. Amoo-Gottfried held various roles at Facebook, Inc. from November 2015 to February 2019, including Vice President of Brand & Consumer Marketing from August 2018 to January 2019. Before joining Facebook, Mr. Amoo-Gottfried served in various roles at advertising agencies, including FCB NY, Leo Burnett and Publicis Groupe, and was also Global Communications Director for Bacardi Rums. Mr. Amoo-Gottfried received his B.A. in economics and international studies from Macalester College. We believe that Mr. Amoo-Gottfried is qualified to serve on our board of directors because of his extensive business and branding experience, including in consumer and foodservice industries.

Age: 44 Director since: 2021 | KOFI AMOO-GOTTFRIED | |||||||||||||

Kofi Amoo-Gottfried has served a member of our Board since January 2021. Mr. Amoo-Gottfried has served as Chief Marketing Officer of DoorDash, Inc. since December 2021. Mr. Amoo-Gottfried previously served as Vice President of Marketing for DoorDash from May 2019 to December 2021. Prior to joining DoorDash, Mr. Amoo-Gottfried held various roles at Facebook, Inc. from November 2015 to February 2019, including Vice President of Brand & Consumer Marketing from August 2018 to January 2019. Before joining Facebook, Mr. Amoo-Gottfried served in various roles at advertising agencies, including FCB NY, Leo Burnett and Publicis Groupe, and was also Global Communications Director for Bacardi Rums. Mr. Amoo-Gottfried has also served on the board of directors of Stitch Fix, Inc. since December 2022. Mr. Amoo-Gottfried received his B.A. in economics and international studies from Macalester College. We believe that Mr. Amoo-Gottfried is qualified to serve on our Board because of his extensive business and branding experience, including in consumer and foodservice industries. | ||||||||||||||

| Favorite farm memory: My favorite farm memory goes all the way back to my childhood in Ghana - visiting the cocoa farms with my dad and getting to watch as the produce got prepared for market. | |||||||||||||

Brent Drever has served as a member of our board of directors since March 2019. Mr. Drever has served as co-founder and President of Manna Tree Partners, an asset management firm focused on improving human health through nutrition, since 2018. Prior to that, Mr. Drever co-founded Acuity Institute in May 2005, a provider of leadership training, coaching and consulting, where he served as chief executive officer from April 2012 to October 2018 and has served as advisor since October 2018. September 2017 to September 2020, Mr. Drever served as co-founder and board president of Zealous Schools, a micro school. In addition to Vital Farms, Inc., Brent currently serves as a Board Member for Nutriati Inc., Verde Farms, and Gotham Greens. Mr. Drever holds a B.S. in Architectural Engineering from the University of Colorado at Boulder. We believe that Mr. Drever is qualified to serve on our board of directors because of his diverse business, management and leadership experience across a variety of industries, including food supply.

| 2024 Proxy Statement | 9 |

Karl Khoury has served as a member of our board of directors since January 2015. Mr. Khoury co-foundedPROPOSAL 1: ELECTION OF DIRECTORS and has served as a partner at Arborview Capital Partners LP, a venture capital firm focused on resource efficiency and sustainability, since the firm’s inception in March 2008. Prior to co-founding Arborview Capital, he served as a partner with Columbia Capital, a sector-focused venture capital firm with over $2 billion under management. In addition to Vital Farms, Mr. Khoury is or has been a member of the board of directors of multiple Arborview Capital portfolio companies. Mr. Khoury is on the board of directors of Impact Capital Managers, a network of private capital fund managers in the U.S. and Canada, and he is on the Board of Trustees of the Levine School of Music. Mr. Khoury received his B.S. in Finance from Lehigh University. We believe that Mr. Khoury is qualified to serve on our board of directors because of his extensive finance and investment experience.

Age: 54 Director since: 2015 | KARL KHOURY Karl Khoury has served as a member of our Board since January 2015. Mr. Khoury co-founded and has served as a partner at Arborview Capital, a venture capital firm focused on resource efficiency and sustainability, since the firm’s inception in March 2008. Prior to co-founding Arborview Capital, he served as a partner with Columbia Capital, a sector-focused venture capital firm with over $2 billion under management. In addition to Vital Farms, Mr. Khoury is a member of the board of directors of multiple Arborview Capital portfolio companies, including Alpen High Performance Products, Kite Hill, Rachio and Soupergirl. Mr. Khoury is on the board of directors of Impact Capital Managers, a network of impact-focused private capital fund managers in the U.S. and Canada. Mr. Khoury is on the Board of Trustees of the MD/DC chapter of the Nature Conservancy, and he is on the Board of Trustees of Levine Music. Mr. Khoury received his B.S. in Finance from Lehigh University. We believe that Mr. Khoury is qualified to serve on our Board because of his extensive finance and investment experience. | |||||||||||

| Favorite farm memory: Our family visits to local apple orchards and pumpkin patches with our three daughters. They are now in high school and college, so our visits have become less frequent the past few years. | |||||||||||

Directors are elected by a plurality of the votes of the holders of shares present or represented by proxy and entitled to vote on the election of directors. Accordingly, the threetwo nominees receiving the highest number of affirmative votes will be elected. You may not vote your shares cumulatively for the election of directors. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the threetwo nominees named above. If any nominee becomes unavailable for election as a result of an unexpected occurrence, your shares will be voted for the election of a substitute nominee proposed by our Board. The Board has no reason to believe that any of the nominees would prove unable to serve if elected. There are no arrangements or understandings between us and any director, or nominee for directorship, pursuant to which such person was selected as a director or nominee.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR EACH OF THE NAMED DIRECTOR NOMINEES.

| THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR EACH OF THE NAMED DIRECTOR NOMINEES. |

Information About Our Continuing Directors

Set forth below are the names, ages and length of service of the remaining members of our Board whose terms continue beyond the Annual Meeting.

Continuing Directors | Age(1) | Term Expires | Position(s) Held | Director Since | ||||||||||||

CONTINUING DIRECTORS | AGE(1) | TERM EXPIRES | POSITION(S) HELD | DIRECTOR SINCE | ||||||||||||

Matthew O’Hayer | 65 | 2023 | Founder, Executive Chairman and Director | 2009 | 68 | 2026 | Founder, Executive Chairperson and Director | 2009 | ||||||||

Russell Diez-Canseco | 48 | 2023 | President, Chief Executive Officer and Director | 2019 | 52 | 2026 | President, Chief Executive Officer and Director | 2019 | ||||||||

Kelly J. Kennedy | 55 | 2026 | Director | 2019 | ||||||||||||

Glenda Flanagan | 67 | 2022 | Director | 2020 | 70 | 2025 | Director | 2020 | ||||||||

Kelly Kennedy | 52 | 2023 | Director | 2019 | ||||||||||||

Denny Marie Post | 66 | 2025 | Director | 2019 | ||||||||||||

Gisel Ruiz | 50 | 2022 | Director | 2020 | 53 | 2025 | Director | 2020 | ||||||||

Denny Marie Post | 63 | 2022 | Director | 2019 | ||||||||||||

| (1) | As of April |

10 | 2024 Proxy Statement |

|

PROPOSAL 1: ELECTION OF DIRECTORS

The principal occupation, business experience and education of each continuing director are set forth below.

Age: 68 Director since: 2009 | MATTHEW O’HAYER Founder and Executive Chairperson Matthew O’Hayer is our founder and has served as a member of our Board since inception and as our Executive Chairperson since April 2019. From September 2007 to April 2019, Mr. O’Hayer served as our Chief Executive Officer. Mr. O’Hayer is also the founder and has served as the president of the Organic Egg Farmers of America, an industry association that hosts agricultural conventions on topics related to organic egg production. We believe that Mr. O’Hayer is qualified to serve on our Board because of his leadership in conceptualizing and developing our brand and business, his deep expertise in the food business, his extensive knowledge of our industry and his 40 years of experience building businesses. | |||||||||||

| Favorite farm memory: I loved collecting eggs on my very first Vital Farm here in Austin. Hens make a beautiful cooing sound when they’re happy. With a flock of a few hundred that can sound like a choir. Sometimes I would get a customer call on my cell phone while with my girls, and they would ask, “what is that racket?” It made me happy to give them the answer. | |||||||||||

Age: 52 Director since: 2019 | RUSSELL DIEZ-CANSECO President and Chief Executive Officer Russell Diez-Canseco has served as our President and Chief Executive Officer since May 2019 and as a member of our Board since December 2019. Prior to this, Mr. Diez-Canseco served as our President and Chief Operating Officer from November 2015 to April 2019, as our Chief Operating Officer from October 2014 to October 2015 and as our Vice President of Operations from January 2014 to September 2014. Prior to joining us, Mr. Diez-Canseco spent several years with McKinsey & Company, a worldwide management consulting firm, H-E-B, a supermarket chain, and the Central Intelligence Agency. Mr. Diez-Canseco received his M.B.A. from Harvard Business School and earned his A.B. in Economics from the University of California at Berkeley. We believe Mr. Diez-Canseco’s strategic vision for our Company and his extensive business experience, including in the food industry, make him qualified to serve on our Board. | |||||||||||

| Favorite farm memory: The first time I visited a Vital Farms farm and was able to experience the rush of birds out into the pasture first thing in the morning. | |||||||||||

| 2024 Proxy Statement | 11 |

PROPOSAL 1: ELECTION OF DIRECTORS

Age: 55 Director since: 2019 | KELLY J. KENNEDY Kelly J. Kennedy has served as a member of our Board since December 2019. Since November 2023, Ms. Kennedy has served as the Chief Financial Officer of Willow Innovations, Inc., which launched the world’s first wearable breast pump. Previously, Ms. Kennedy served as the Chief Financial Officer of The Honest Company from January 2021 to September 2023, and as the Chief Financial Officer of The Bartell Drug Company, a family-owned pharmacy chain from September 2018 until its sale to Rite Aid in December 2020. Since December 2023, Ms. Kennedy has served on the board of directors of GoodRx Holdings, Inc., where she is a member of the Audit Committee. Ms. Kennedy has also served on the boards of directors of FirstFruits Farms LLC since December 2019, of RAD Power Bikes since July 2021 and of Skinny Mixes, LLC since July 2023. fuMs. Kennedy served on the board of directors of Sur La Table, Inc. from September 2018 to November 2020. Ms. Kennedy received her M.B.A. from Harvard Business School and her B.A. in Economics from Middlebury College. We believe that Ms. Kennedy is qualified to serve on our Board because of her comprehensive financial expertise and experience with retail and consumer brands, including those in the food space. | |||||||||||

| Favorite farm memory: This may not be “favorite,” but my most memorable was learning what an electric fence was on my first visit to my family’s farm in Michigan. Ouch! | |||||||||||

Age: 70 Director since: 2020 | GLENDA FLANAGAN | |||||||||||

Glenda Flanaganhas served as a member of our Board since July 2020. In March 2022, Ms. Flanagan became the Executive Vice President and Chief Financial Officer and a member of the board of directors of Healthy America, LLC. Ms. Flanagan served as the Executive Vice President and Chief Financial Officer of Whole Foods Market, Inc. from 1988 through May 2017. From May 2017 through February 2022, she served as the Executive Vice President and Senior Advisor at Whole Foods. Additionally, Ms. Flanagan currently serves on the boards of directors of Whole Foods Market Foundation, as well as the public company Credit Acceptance Corporation. Ms. Flanagan holds a B.B.A. in accounting from the University of Texas at Austin. We believe Ms. Flanagan is qualified to serve as a member of our Board due to her extensive experience with a leading consumer and health-related brand, and her expertise and background with regard to accounting and financial matters. | ||||||||||||

| Favorite farm memory: When I was a young girl in Austin, my grandparents had a farm just outside of town and we would go to visit them almost every Sunday. They frequently saved the eggs for us to collect – we loved carrying the baskets down to the chicken yard and then feeling the warmth of the freshly laid eggs. Now my sister lives on a farm, and I love watching my grandkids get to do the same – they love it. | |||||||||||

12 | 2024 Proxy Statement |

|

PROPOSAL 1: ELECTION OF DIRECTORS

Age: 53 Director since: 2020 | GISEL RUIZ Gisel Ruizhas served as a member of our Board since May 2020. Ms. Ruiz has also served on the boards of directors of Cracker Barrel Old Country Store, Inc. since September 2020, of Univision Communications Inc. since November 2020, of Ulta Beauty, Inc. since March 2022, and of Executive Network Partnering Corporation from September 2020 to October 2022. Prior to that, Ms. Ruiz served as Executive Vice President and Chief Operating Officer of Sam’s West, Inc., a national chain of membership-only retail warehouse clubs, from February 2017 to June 2019. Ms. Ruiz has also held multiple leadership positions at Walmart, Inc., both in the U.S. and international business segments from 1992 through February 2017, including executive roles from 2010 to February 2017. Ms. Ruiz served on the board of directors of Walmart de Mexico S.A.B. de CV, a multinational retail chain from October 2016 to May 2019. Ms. Ruiz received her B.S. in Marketing and is a graduate of the Retail Management Institute program at Santa Clara University. She is currently on the Santa Clara University board of advisors serving the Retail Management Institute. We believe that Ms. Ruiz is qualified to serve on our Board because of her diverse business, management and leadership experience in the consumer and food industries. | |||||||||||

| Favorite farm memory: My mom and dad met while working the fields of the San Joaquin Valley. I remember my dad driving my sister and me out to the fields with him, and we’d jump out of his truck to pick fresh tomatoes or cantaloupes to bring home for my mom. We would bring back enough to share with our favorite neighbors across the street. | |||||||||||

Age: 66 Director since: 2019 | DENNY MARIE POST | |||||||||||||

Denny Marie Post has served as a member of our Board since December 2019. Ms. Post has served on the board of directors of Travel & Leisure Co. since May 2018, Bluestone Lane Holdings since October 2020 and Libbey, Inc. since November 2020. Ms. Post previously served as Co-President of Nextbite, a virtual restaurant and online order management business. Prior to that, Ms. Post served on the board of directors of Red Robin Gourmet Burgers, Inc., a casual dining restaurant chain, from August 2016 to April 2019 and served in a variety of senior management roles from August 2011 to April 2019, including President, Chief Executive Officer, Chief Concept Officer and Chief Marketing Officer. Ms. Post has previously held management positions at T-Mobile US, Inc., Starbucks Corporation, Burger King Worldwide Inc., and KFC USA as well as priszm brandz (a joint venture of YUM! Brands, Inc.). Ms. Post received her certificate in Finance from Wharton School of Business at the University of Pennsylvania and her B.A. in Journalism and Social Sciences from Trinity University. We believe that Ms. Post is qualified to serve on our Board because of her diverse business, management and leadership experience in the consumer, food and hospitality industries. | ||||||||||||||

| Favorite farm memory: | |||||||||||||

| 2024 Proxy Statement | 13 |

PROPOSAL 1: ELECTION OF DIRECTORS

Director Skills and Qualifications

In addition to the information provided in our directors’ biographies and elsewhere in this proxy statement, the following matrix summarizes certain skills and experience of our boardcurrent directors, taking into account a number of directors since inceptionqualifications we believe are important for service on our Board. This matrix is based on self-reported data collected from our directors. The matrix is intended to provide a summary of our directors’ self-reported qualifications and asshould not be considered to be a complete list of each director’s strengths and contributions to our executive chairman sinceBoard.

In assessing candidates for director nomination, our Board and Nominating and Corporate Governance Committee consider, among other things, candidates’ diversity (including diversity of gender identity, ethnic background and country of origin), age, skills and other factors deemed appropriate to maintain a balance of knowledge, experience, tenure and capability on our Board. Our previous year’s disclosure can be found in our definitive proxy statement filed with the SEC on April 2019. From September 2007 to April 2019, Mr. O’Hayer served as24, 2023.

In accordance with applicable listing requirements of The Nasdaq Stock Market (“Nasdaq”), the following table presents our chief executive officer. Mr. O’Hayer is also the founder and has served as the presidentBoard diversity statistics. Each of the Organic Egg Farmers of America, an industry association that hosts agricultural conventions on topics related to organic egg production. We believe that Mr. O’Hayer is qualified to serve on our board of directors because of his leadership in conceptualizing and developing our brand and business, his deep expertisecategories listed in the food business, his extensive knowledge of our industry and his 40 years of experience building businesses.table below has the meaning ascribed to it in Nasdaq Rule 5605(f).

| BOARD DIVERSITY MATRIX (AS OF APRIL 29, 2024) | ||||||||

Total Number of Directors | 8 | |||||||

|

| FEMALE | MALE | NON-BINARY | DID NOT DISCLOSE GENDER | ||||

Part 1: Gender Identity | ||||||||

Directors | 4 | 4 | 0 | 0 | ||||

Part 2: Demographic Background | ||||||||

African American or Black | 0 | 1 | 0 | 0 | ||||

Hispanic or Latinx | 1 | 1 | 0 | 0 | ||||

White | 3 | 3 | 0 | 0 | ||||

Two or More Races or Ethnicities | 0 | 1 | 0 | 0 | ||||

LGBTQ+ | 0 | |||||||

Did Not Disclose Demographic Background | 0 | |||||||

14 | 2024 Proxy Statement |

|

Russell Diez-Canseco has served as our president and chief executive officer since May 2019 and as a member of our board of directors since December 2019. Prior to this, Mr. Diez-Canseco served as our president and chief operating officer from November 2015 to April 2019, as our chief operating officer from October 2014 to October 2015 and as our vice president of operations from January 2014 to September 2014. Prior to joining us, Mr. Diez-Canseco spent several years with McKinsey & Company, a worldwide management consulting firm, H-E-B, a supermarket chain, and the Central Intelligence Agency. Mr. Diez-Canseco received his M.B.A. from Harvard Business School and earned his A.B. in Economics from the University of California at Berkeley. We believe Mr. Diez-Canseco’s strategic vision for our company and his extensive business experience, including in the food industry, make him qualified to serve on our board of directors.

Glenda Flanaganhas served as a member of our board of directors since July 2020. Ms. Flanagan served as the Executive Vice President and Chief Financial Officer of Whole Foods Market, Inc. (“Whole Foods”), the natural and organic food supermarket chain acquired by Amazon, Inc. in 2017, from 1988 through May 2017. Since then she has served as the Executive Vice President and Senior Advisor at Whole Foods. Ms. Flanagan currently serves on the boards of directors of Whole Planet Foundation, Whole Cities Foundation, and Whole Kids Foundation, as well as the public company Credit Acceptance Corporation. Ms. Flanagan holds a B.B.A. in accounting from the University of Texas at Austin. Ms. Flanagan was selected to serve as a member of our board of directors due to her extensive experience with a leading consumer and health-related brand, and her expertise and background with regard to accounting and financial matters.

Kelly Kennedy has served as a member of our board of directors since December 2019 and has also served as a member of the board of directors of FirstFruits Farms LLC since December 2019. Ms. Kennedy has served as the chief financial officer of The Honest Company since January 2021. Ms. Kennedy served on the board of directors of Sur La Table, Inc. from September 2018 to November 2020. Ms. Kennedy served as the chief financial officer of The Bartell Drug Company, a family-owned pharmacy chain from September 2018 until its sale to Rite Aid in December 2020. Prior to that, Ms. Kennedy served as the chief financial officer of Sur La Table from June 2015 to September 2018, as the chief financial officer of See’s Candies from January 2014 to June 2015 and as the chief financial officer and treasurer of Annie’s Inc. from August 2011 to November 2013. Ms. Kennedy has also served in various roles at Revolution Foods, Inc., Established Brands, Inc., Serena & Lily Inc., Forklift Brands, Inc., Elephant Pharm, Inc., Williams-Sonoma, Inc. and Dreyer’s Grand Ice Cream Holdings, Inc. Ms. Kennedy received her M.B.A. from Harvard Business School and her B.A. in Economics from Middlebury College. We believe that Ms. Kennedy is qualified to serve on our board of directors because of her comprehensive financial expertise and experience with retail and consumer brands, including those in the food space. As described above, Ms. Kennedy served as a director of Sur La Table, where she also served as chief financial officer from June 2015 to September 2018. Sur La Table filed a voluntary petition for bankruptcy on July 8, 2020. Except as described in the preceding sentence, no other event has occurred during the past 10 years requiring disclosure pursuant to Item 401(f) of Regulation S-K.

Denny Marie Post has served as a member of our board of directors since December 2019. Ms. Post has served on the board of directors of Travel + Leisure, Inc. since May 2018, Bluestone Lane Holdings since October 2020 and Libbey, Inc. since November 2020. Prior to that Ms. Post served on the board of directors of Red Robin Gourmet Burgers, Inc., a casual dining restaurant chain, from August 2016 to April 2019 and served in a variety of senior management roles from August 2011 to April 2019, including president, chief executive officer, chief concept officer and chief marketing officer. Ms. Post has previously held management positions at T-Mobile US, Inc., Starbucks Corporation, Burger King Worldwide Inc., and KFC USA as well as Priszm Brandz Canada (a joint venture of YUM! Brands, Inc.). Ms. Post received her certificate in Finance from Wharton School of Business at the University of Pennsylvania and her B.A. in Journalism and Social Sciences from Trinity University. We believe that Ms. Post is qualified to serve on our board of directors because of her diverse business, management and leadership experience in the consumer, food and hospitality industries.

Gisel Ruizhas served as a member of our board of directors since May 2020. Ms. Ruiz has also served on the board of directors of Cracker Barrel Old Country Store, Inc. since September 2020. Prior to that, Ms. Ruiz

served as executive vice president and chief operating officer of Sam’s West, Inc., a national chain of membership-only retail warehouse clubs, from February 2017 to June 2019. She is currently on the board of advisors at Santa Clara University serving the Retail Management Institute. Ms. Ruiz served on the board of directors of Walmart de Mexico S.A.B. de CV, a multinational retail chain, from October 2016 to May 2019. Ms. Ruiz also held multiple positions at Walmart, Inc., both in the U.S. and international business segments, from 1992 through February 2017, including executive roles from 2010 to February 2017. Ms. Ruiz received her B.S. in Marketing, Retail Management from Santa Clara University. We believe that Ms. Ruiz is qualified to serve on our board of directors because of her diverse business, management and leadership experience in the consumer and food industries.

INFORMATION REGARDING THE BOARD AND CORPORATE GOVERNANCE

Corporate Governance Highlights

Board Executive Chairperson and Chief Executive Officer positions are separate

6 of 8 directors are independent, including each member of the Board’s standing committees

6 of 8 directors (including the chairperson of each standing committee) are women and/or members of underrepresented minority groups

Lead independent director

Regular committee meetings and executive sessions without members of management present

Annual Board and committee self-evaluations and review of committee charters

Overall attendance by our directors at Board and committee meetings of 97% in 2023

As required under The

Under Nasdaq Stock Market (“Nasdaq”) listing standards, a majority of the members of a listed company’s Board must qualify as “independent,” as affirmatively determined by the Board. The Board consults with the Company’s counsel to ensure that the Board’s determinations with respect to independence are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect from time to time.

Based on information provided by each director concerning herhis or hisher background, employment and affiliations, the Board has determined that none of our directors, other than Mr. Diez-Canseco Ms. Flanagan and Mr. O’Hayer, has any relationships that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the Nasdaq listing standards. In making these determinations, our Board considered the current and prior relationships that each non-employee director has with our company and all other facts and circumstances that our Board deemed relevant in determining their independence, including the beneficial ownership of our shares by each non-employee director and the transactions described in the section titled “Transactions with Related Persons.”independence. The Board also determined that each member of our Audit, Compensation and Nominating and Corporate Governance Committees satisfies the independence standards for such committees established by the SEC and the Nasdaq listing standards, as applicable.

Leadership Structure and Risk Oversight

Our Corporate Governance Guidelines specify that the Board will select our Chief Executive Officer and chairperson of the Board in the manner that itthe Board determines to be in the best interests of our stockholders and in accordance with any stockholder agreements. The Board does not believe there should be a fixed rule regarding the positions of Chief Executive Officer and chairperson being held by different individuals, or whether the chairperson should be a Vital Farms employee or should be elected from among the non-employee directors. The needs of Vital Farms and the individuals available to assume these roles may require different outcomes at different times, and the Board believes that retaining flexibility in these decisions is in the best interests of our company.Company.

Pursuant to its charter, the Nominating and Corporate Governance Committee periodically reviews this matter and makes recommendations to the Board. Most recently, the Nominating and Corporate Governance Committee has recommended, and the Board has determined, that the roles of Chief Executive Officer and chairperson of the Board should continue to be separate. The role of executive chairpersonExecutive Chairperson is currently held by MatthewMr. O’Hayer, our founder, who has served in such capacity since April 2019. Our Corporate Governance Guidelines further specify that in the event that we do not have an independent chairperson of the Board, the independent directors may designate a lead independent director. Our lead independent director is Denny MarieMs. Post, who has served in such capacity since August 2020. The lead independent director’s duties include: (i) presiding at all meetings of the Board at which the chairperson is not present, including executive sessions of the independent directors; (ii) acting as liaison between the independent directors and the Chief Executive Officer and chairperson; (iii) presiding over meetings of the independent directors; (iv) consulting with the chairperson in planning and setting schedules and agendas for Board meetings; and (v) performing such other functions as the Board may delegate.

16 | 2024 Proxy Statement |

|

INFORMATION REGARDING THE BOARD AND CORPORATE GOVERNANCE

One of the Board’s key functions is informed oversight of our risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, including a determination of the nature and level of risk appropriate for the Company.

Our Audit

Committee has the responsibility to consider and discuss with the Company’s management and the auditors, as appropriate, the Company’s guidelines and policies with respect to financial riskthe management and financialassessment of risk assessment,in all areas of the Company’s business, including the Company’s major financial, accounting, operational, tax, legal, compliance and privacy risk exposures and the steps taken by management to monitor and control these exposures. In addition, the Audit Committee considers managementmaterial risks relating to data privacy, technology and information security, including cyber security,cybersecurity, threats and back-up of information systems and the steps the Company has taken to monitor and control such exposures, as well as overseeing the performance of our internal audit function, as applicable.

Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking, including risks related to executive compensation and overall compensation and benefit strategies, plans, arrangements, practices and policies. The Compensation Committee also reviews and oversees risk management policies and practices relating to human capital management.

Our Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance guidelines,Corporate Governance Guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. The Nominating and Corporate Governance Committee also overseesreviews and reviews with managementoversees the Company’s major legal complianceStock Ownership Guidelines (as applicable to our non-employee directors). Additionally, the Nominating and Corporate Governance Committee monitors the Company’s risk exposures related to environmental, social and the steps management has taken to monitor or mitigate such exposures,governance matters and corporate social responsibility matters, including the Company’s procedures and any related policies with respect to risk assessment and risk management. climate-related risks.